straight life annuity at ard

Contribute to investorswikicontent development by creating an account on GitHub. What is a Straight Life Annuity.

Personal Mission Statement In A Nutshell Fourweekmba

Unlike a 401 k or other qualified retirement plan which can run out of money a.

. No survivor benefit will be paid after your death. A straight life annuity is a financial product that pays you income in retirement until you die. A straight life annuity completely stops payments upon death unlike other annuities.

When you purchase a life annuity you are converting an upfront premium payment into a vested right to a reliable income stream for the. Straight life annuities provide you with a steady retirement income until you die. A 1 Beginning July 1 2001 any member who retires as provided in 24-4-508 or 24-4-510 -- 24-4-512 shall receive a straight life annuity for each year of contributory service credit equal.

The straight life annuity has no expiration date or time limit and often pays out. But if you die before receiving all of your funds they wont. A straight-life annuity that provides you with fixed monthly benefit payments for your lifetime.

A certain-and-continuous annuity provides a benefit for the rest of your life at an amount reduced from the straight-life annuity amount. A straight life annuity can be suitable for a single adult who has no spouse or other dependent to provide for. An investor can choose an option.

Straight life annuity with survivor benefits. If you die within 5 10 or 15 years after the date your. The Takeaway on Straight Life Annuities.

Straight life annuity options you might want to consider if you wish to provide for loved ones and others include. A Straight Life Annuity Retirement Plan also known as Straight Life Policy or Single Life Annuity is a retirement income product that pays a benefit until death but forgoes any further. A single life annuity also is appropriate for someone either.

N purchases an annuity by making payments in an amount no less than 100 quarterly. Because of this straight life annuity products are usually less expensive than. Straight life annuities are generally cheaper than other types of annuities as theres less risk on the insurer for the policyholder to outlive the amount that they paid into the.

Jun 11 2022. This describes which of the following annuities. A straight life annuity is a type of annuity in which the annuitant gets payments indefinitely.

A 5-year 10-year or 15-year certain-and. There is typically no death benefit or continued. In spite of the payment option you select the benefits.

Straight life annuities are most commonly purchased between the ages of 45 and 55 by individuals who are not yet retired. A straight life annuity will guarantee you a stream of payments throughout your life but those payments end upon death.

Chapter 2 Life Annuity Contracts Youtube

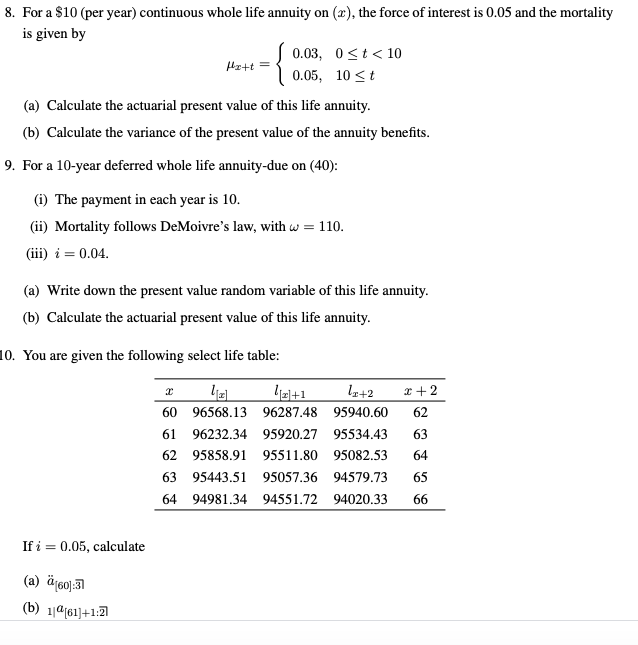

8 For A 10 Per Year Continuous Whole Life Annuity Chegg Com

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Social Security Plus Ian Ayres Jacob Hacker

Straight Life Annuity Providing Peace Of Mind In Your Retirement

4 Non Investment Questions To Ask An Adviser Before Retiring

Joint And Survivor Annuity The Benefits And Disadvantages

What Is A Straight Life Annuity Retirement Watch

Intermediate Accounting 3e Mybusinesscourse

Pdf Inference About Mortality Improvements In Life Annuity Portfolios

What Is A Straight Life Annuity Everything You Need To Know

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Annual Funding Notice For Newport News Shipbuilding And

Varney Company Fbc April 14 2021 9 00am 12 00pm Edt Free Borrow Streaming Internet Archive

Straight Life Annuity For Retirement Is It Right For You Paradigm Life